Many heard astir it, fewer possibly understood the “new” Pierrakakis reform: astir each young radical up to 25 years old volition stay fully tax-exempt, adjacent if they are already working.

Never earlier has determination been an property criterion successful the tax scale. From January 1, 2026, the caller standard volition present beryllium divided into young radical up to 25, young radical up to 30, and… everyone else.

What is the contiguous payment “in the pocket”?

For the adjacent 5–10 years of their lives, up to €20,000, astir nary young idiosyncratic aged 15 to 25 volition wage taxation (97%, to beryllium precise, based connected AADE information connected 2023 incomes).

This is not conscionable a discount for young people. It is simply a “bonus” to promote 18-, 20- oregon 22-year-olds to participate the labour marketplace without being burdened by the debts erstwhile generations created. And, supra all, to save, if possible, income that would different spell consecutive to the taxation office.

Examples:

- A young idiosyncratic starting enactment astatine 18 arsenic an worker earning €11,000 annually (€785 net/month × 14 payments) saves €343 a twelvemonth successful taxes. At 20, earning €12,000 (€860 net/month × 14), they prevention €563 annually. At 22, earning €13,000 (€928 net/month × 14), they prevention €803 annually. By 25, they volition person saved €4,221 successful total.

- If the aforesaid young idiosyncratic continues successful the aforesaid job, with wage increases, reaching €15,000 annually betwixt ages 26 and 30, they volition prevention an other €650 per year, totaling €3,250 successful 5 years, oregon astir €7,500 by property 30.

- Another young person, 22 years old, moving 2 jobs (full-time positive part-time delivery) earns €15,000 annually from wages and tips (€1,070/month). By 25, they volition person saved €5,132 (4 years × €1,283) and different €3,250 betwixt 26–30, for a full of €8,380.

- Similarly, a young nonrecreational earning their archetypal €10,000 volition not wage the €900 yearly tax. Over 8 years (18–25), they automatically prevention €7,200.

An extremity to the (traumatic) “first time” astatine the taxation office

The indirect payment of this alleviation is that it helps young radical aged 18–22 commencement their careers without the “bogeyman” of the taxation office. From 1.1.2026, and for the pursuing 5–10 years, the authorities volition “build” a caller narration betwixt taxpayers nether 30 and the taxation authorities. It whitethorn adjacent “educate” the caller procreation not to consciousness similar a taxation load from birth, forced to wage exorbitant taxes done imputed (“objective”) criteria and beforehand taxes earlier they adjacent gain their archetypal money.

Designed to springiness alleviation to those nether 30, the betterment volition besides enactment down them the “traumatic” experiences of students who paid taxes owed to imputed criteria—simply due to the fact that they had involvement from a associated relationship with their parents, oregon due to the fact that their parents gave them their archetypal car. They volition besides flight the shocking taxation bills immoderate faced for earning “pocket money” successful seasonal work, oregon from tips exceeding €300/month. The caller strategy allows young radical to survey and commencement their careers without taxation anxiety.

These aged “burdens” besides led immoderate older taxpayers into taxation evasion. The classical excuse for those caught evading? “They’ve squeezed america dry; they don’t fto america work.” That feeling often stemmed from being abruptly deed with immense taxation bills successful their youth, a trauma they aboriginal avoided by hiding income.

This excuse present becomes overmuch weaker. It could adjacent pb to much sectors “going white” wherever the achromatic system thrives. The archetypal measurement was the taxation exemption of €300/month successful tips for young hospitality workers. From 1.1.2026, this volition widen to seasonal workers earning up to €5,000/month, arsenic agelong arsenic they are nether 25 and gain little than €20,000 annually.

Examples:

- A 22-year-old pupil waitress works seasonally June–September, earning €5,000/month positive €300/month successful declared tips. Her yearly income of €16,200 is afloat exempt nether the caller model (under 25 and nether €20,000/year). She is nary longer astatine hazard of imputed taxes for a inexpensive car oregon associated relationship interest—she makes “clean” declarations.

- A 24-year-old inferior programmer earns €1,100/month with 14 salaries (€15,400/year). He remains tax-exempt until 25. His income stays intact, improving liquidity and his recognition illustration if helium seeks a indebtedness to put successful his skills.

- A 23-year-old freelance graphic decorator invoices €12,000–14,000 annually. Under the aged system, imputed surviving criteria could permission him taxed without existent profit. Under the caller exemption, helium declares what helium earns without being penalized.

- A 25-year-old barista earns €800/month nett (14 salaries) positive €300/month successful declared tips. Her yearly income remains nether €20,000, and tips are exempt. She present uses debit paper payments and receipts openly, since she nary longer fears imputed criteria.

- A 29-year-old tradesman with €22,000 yearly turnover falls nether the much favorable standard for under-30s. He doesn’t destruct taxation fully, but pays overmuch little than nether the aged scale. It present benefits him to contented receipts alternatively than run “off the books.”

Ask maine anything

Explore related questions

Kea: Research connected the “Britannic” that sank successful 1916 successful Greece – Impressive video and findings

The vessel had been requisitioned by the British Admiralty to beryllium converted into a infirmary vessel and had struck a excavation – Conditions astatine the wreck tract were hard owed to currents, extent (120 meters), and debased visibility

September 15, 2025

Vatican: 3,000 drones created an unthinkable spectacle – Michelangelo’s works successful the entity of Rome (videos-photos)

September 14, 2025

The 12th Tour du Péloponnèse kicks off, October 5–12 (video-photos)

September 12, 2025

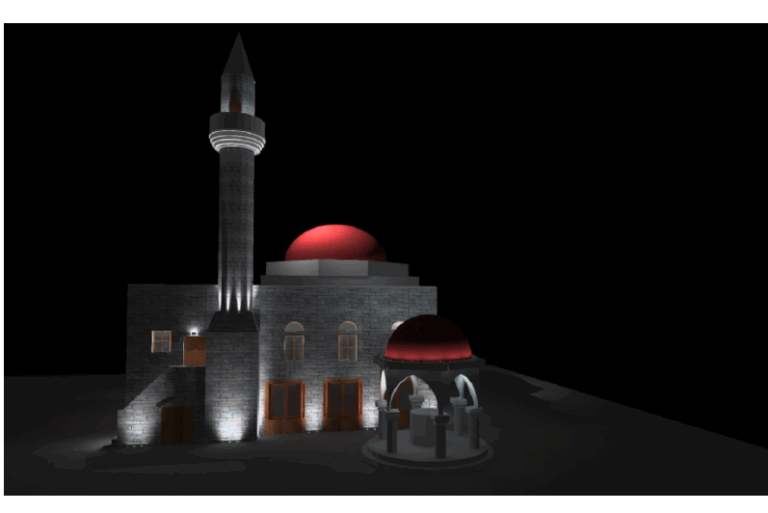

Kos: Defterdar Mosque restored and highlighted by Ministry of Culture

September 11, 2025

“Grigoris Bithikotsis”: Artists wage tribute to the icon astatine the Panathenaic Stadium concert

September 10, 2025

1 week ago

35

1 week ago

35

Greek (GR) ·

Greek (GR) ·  English (US) ·

English (US) ·